The Best Environment for Whole Life in 80 Years

By Tom Wall

If it’s 80 degrees outside, is it hot? The answer may depend on who you ask and where they come from. Our neighbors up north in Canada would likely shout an emphatic yes as they wipe sweat from their forehead. Friends in southern Texas might add a layer as they rejoice in the cold front passing through.

It’s all relative.

While dividend interest rates are at their lowest in over 50 years, one may feel like the best days for whole life are behind it. But any time you consider value or performance, you must consider it in relation to something else. Investors use asset class indexes as benchmarks for performance. Meteorologists use seasonal averages to decide what’s newsworthy. And in the case of whole life insurance, you must consider what the alternatives are for your cash and conservative investments.

When considering alternatives to the guaranteed cash value growth of whole life, the list is pretty short and sad. Cash in the bank earns next to nothing these days, and whatever you’re actually able to earn is taxable. If you can give up access (but not guarantees) for a little while, short term bonds or CDs may get you 1-2%, but still taxable. Anything else, and you’re generally adding market risk, interest rate risk, or liquidity risk. From this viewpoint, once you get over the hurdle of the up-front costs of whole life insurance, it becomes a much better bond and alternative to cash due to its near-complete liquidity with yields mirroring long-term averages. I discussed this in detail in “The Best ‘Boring’ Money Can Buy.”

There are a LOT of people in the industry echoing the sentiment that whole life insurance is a great alternative to bonds. I personally wouldn’t recommend a client entirely replace bonds in their portfolio (because of what they say about baskets and eggs), but most should at least consider diversifying a major portion of their bond allocation toward whole life. This is because whether rates stay low or go up, whole life should perform better than bonds. But does that hold up to academic scrutiny? Or is that just the opinion of a bunch of biased salespeople?

Research: How would a modern 10-Pay whole life policy cash value have performed over time based on historical dividends?

There are major problems with validity of all historical examples I’ve seen insurance companies put out. First, they aren’t dynamic, based on only one policy issued at one point in time. This often means results were cherry-picked, and wise people are dubious of such “studies.” Second, the policies are historical, with different mortality tables, underwriting classes, expenses, guaranteed rates, and designs than the ones issued today. You can’t buy them anymore, so their relevance is questionable.

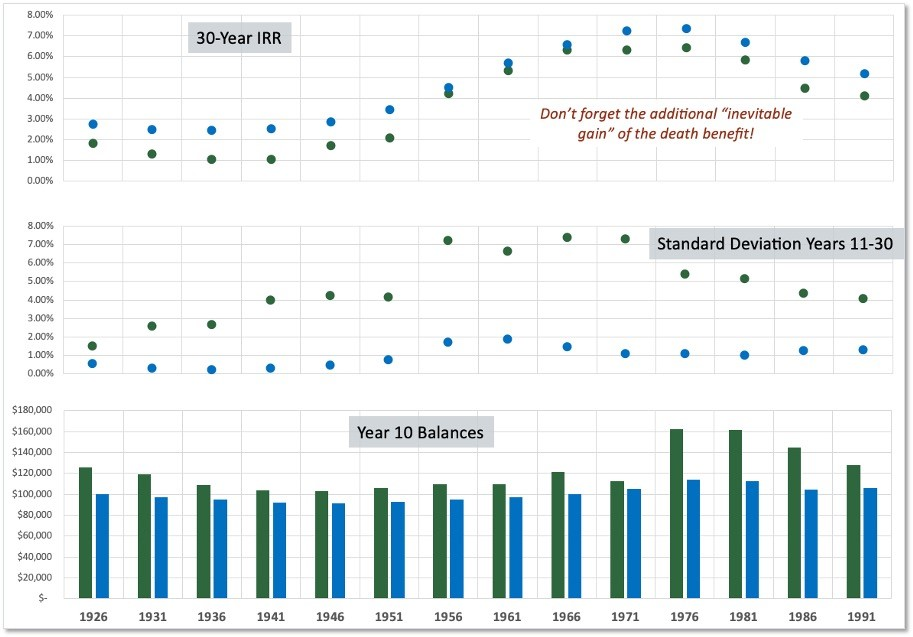

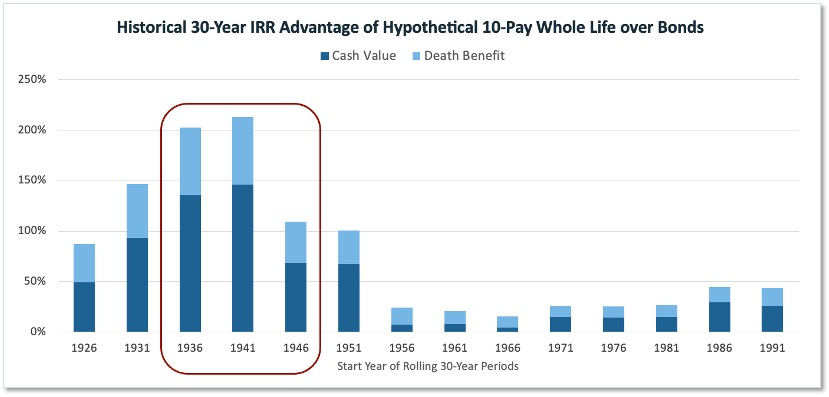

In my research below, I used a data set for bonds that started in 1926 and the actual dividend interest rates of a major mutual life insurer of the time. I then conducted 14 different studies that each started 5 years apart, in 1926, 1931, 1936,… 1991, and spanned 30 years. The studies compared the same 10 payments into a hypothetical 10-Pay Whole Life insurance policy against the same 10 payments into a bond fund. The “bond fund” was a blend of long-term corporate bond returns and intermediate term government bonds, and the whole life insurance policy performance was modeled based on historical dividend intererest rates. To accurately model the whole life performance, a currently-available 10-Pay Whole Life policy on a 50-year-old male was illustrated at various levels of interest rate performance with year-over-year rates of change placed into a model. Against that model, historical rates were applied to show how a modern policy would have likely changed over that period of time. Modest adjustments were made to bond returns to account for investment fees and taxes, and a small enhancement from other business earnings was applied to whole life dividends. All adjustments were understated and well below actual norms today, so no undue advantage was attributed to whole life. The results were eye-popping.

WL Cash Value vs. Bond Fund Value

View the three sections above in reverse order, from the bottom up:

- In each 30-year period studied, a policy owner would have had more value in their bond fund at the end of 10 years. This makes sense, because bond investments don’t carry the high up-front costs of whole life insurance.

- However, the non-volatility of whole life insurance and its guarantee to rise in value every year shined brightly in the subsequent 20 years. Measured in terms of standard deviation, bonds were 5x more volatile than whole life. Also keep in mind that any “volatility” with whole life was all positive. It went up, the only variance was by how much each year.

- Most importantly, whole life outperformed in every period studied. 30-year IRRs for whole life were compared to actual returns for bond funds. Bonds did better to the extent their 30-year return pattern included the 1980’s, particularly when those years fell later in the period. Outside this extraordinary bull market in bonds, whole life delivered massive outperformance.

The 1930s into the 1940s represents the last time interest rates were as low as they are today. The couple of studies in 1926 and 1931 represent a relatively level (and low) interest rate environment. The subsequent 4 studies show what it looked like purchasing whole life insurance vs. investing in bonds in a rising interest rate environment. Read this as a reminder of why bonds will suffer in a rising rate environment.

In short, whole life has been most attractive in low-rate environments, relative to its alternatives. NOW is the time to get your clients into whole life insurance and diversify away from an asset class that will at best provide paltry returns (if rates stay low), but could suffer massive volatility and losses (if rates rise). And no need to take my word for it – rates have actually come up quite a bit this year. Check out what’s happening with bonds YTD.

Right now it’s 60 degrees in whole life land – well below historical averages. But the rest of the safe-money world is in a deep freeze and would kill for the temperatures we’re experiencing. The year’s almost half-over. Call your clients today and let them in on the best kept secret in the business.